Cash Advance Top Benefits

Wiki Article

Understanding Installment Loans: Key Facts and Functions You Should Know

Installation lendings are a common economic device that several people run into - Cash Loans. They supply debtors a swelling amount that is paid back in dealt with month-to-month payments over a specified duration. Understanding their framework and ramifications is important for making educated economic decisions. As borrowers take into consideration these loans for significant expenditures, various aspects enter into play. What are the vital details and potential challenges that should know prior to committing to an installation funding?What Are Installment Loans?

Installation loans are a sort of financing that enables consumers to receive a swelling amount of cash upfront, which they after that pay off over a collection period via set up payments. Typically, these car loans included fixed passion rates, making sure that regular monthly payments stay consistent throughout the payment term. Borrowers might make use of installment loans for different purposes, consisting of purchasing a car, moneying home enhancements, or consolidating financial obligation. The payment terms can differ, often varying from a couple of months to several years, depending on the loan provider and the quantity borrowed.Before securing an installation lending, individuals ought to assess their economic circumstance and capability to make routine payments. If settlements are made on time, this kind of funding can help develop credit report history. However, failing to satisfy repayment commitments can result in negative consequences, consisting of enhanced debt and a damaged credit report rating, making it essential for borrowers to come close to these financings with caution and consideration.

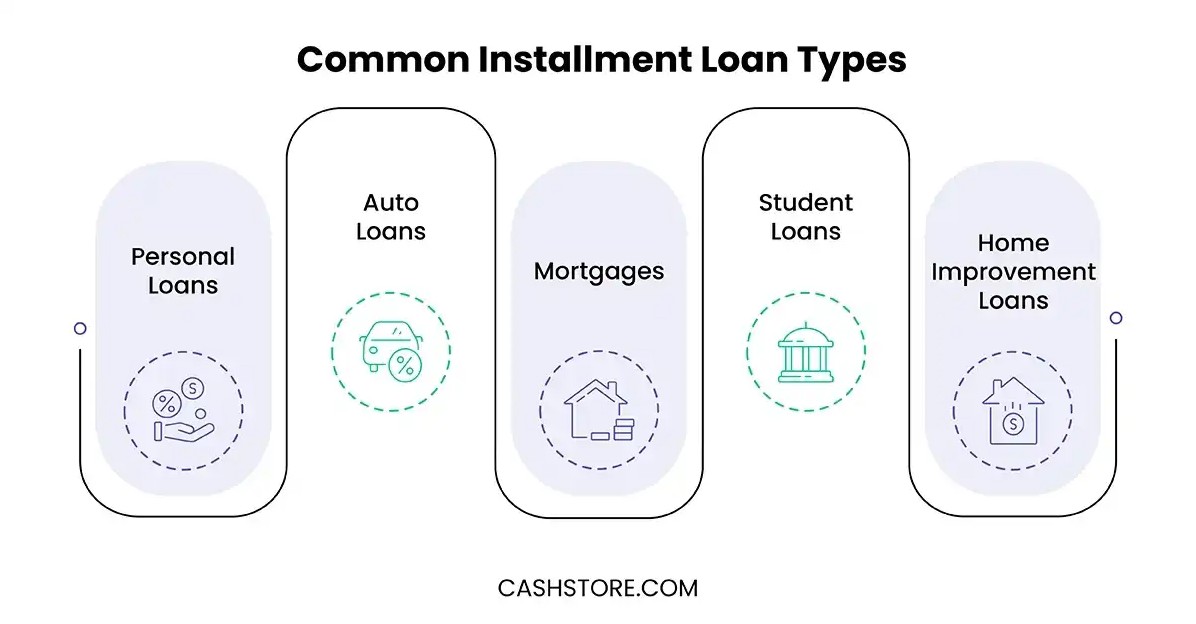

Sorts Of Installation Loans

Different kinds of installation finances provide to different financial demands and situations. Individual car loans are amongst one of the most typical, offering individuals the adaptability to utilize funds for different objectives, such as financial debt combination or unexpected costs. Automobile lendings particularly fund automobile acquisitions, allowing debtors to pay for their autos in time. Home equity lendings make it possible for home owners to obtain against their home's equity, frequently made use of for home enhancements or major expenses. Pupil fundings aid finance education, with different settlement choices customized to grads' revenue levels. In addition, medical car loans supply financial help for medical care expenditures, often with positive terms. Specific finances, such as trip or wedding celebration loans, offer specific niche requirements, enabling customers to finance memorable experiences. Each sort of installment funding features distinct terms and conditions, making it vital for borrowers to assess their specific scenarios before choosing the most suitable choice.Exactly How Installment Loans Work

Recognizing exactly how installment car loans function is essential for borrowers. The process begins with a financing application, adhered to by a clearly specified repayment structure and rate of interest that affect the general cost. Each of these components plays an essential duty in establishing the expediency and cost of the financing.Funding Application Refine

When looking for an installation lending, borrowers have to navigate an organized application process that generally starts with gathering essential economic info. This consists of information regarding income, employment, and existing financial debts, which loan providers make use of to evaluate creditworthiness. Next, debtors submit a finance application, providing individual info and the wanted car loan amount. Lenders may call for documentation, such as pay stubs or bank statements, to validate the info offered. As soon as sent, the lender evaluates the application, evaluates the consumer's credit report, and determines eligibility. If accepted, the debtor receives a finance deal laying out terms, interest rates, and settlement conditions. Customers should carefully evaluate the deal before accepting, guaranteeing it fulfills their economic demands and capacities.Repayment Structure Explained

Although the specifics of payment can vary by loan provider, installation financings generally include a simple structure that involves dealt with monthly settlements over a fixed duration. Consumers obtain a round figure upfront and accept settle the complete quantity, plus any type of suitable charges, over a set term, generally ranging from a few months to several years. Each settlement is composed of both principal and interest, permitting borrowers to progressively minimize their outstanding equilibrium. This predictable settlement timetable help in budgeting, as borrowers understand precisely how much to assign each month. Additionally, many lenders offer flexibility in repayment techniques, enabling consumers to select options that ideal fit their financial circumstances. Generally, the structured nature of installation lendings makes them a workable borrowing alternative.Rate Of Interest Introduction

Rate of interest play a vital role in establishing the general price of an installation car loan. These prices, which can be repaired or variable, influence the month-to-month payment amount and the overall interest paid over the car loan term. A set rate of interest continues to be constant throughout the finance period, providing predictability in budgeting. On the other hand, a variable rate of interest may change based on market conditions, potentially causing higher or lower repayments gradually. Lenders analyze various factors, including debt car loan, score, and revenue term, to figure out the rate provided to customers. Comprehending these prices is necessary for consumers, as they directly effect economic planning and the cost of the funding. As a result, cautious consideration of the rates of interest is crucial when selecting an installation finance.Secret Terms to Know

One essential term is "major," which describes the initial amount borrowed. "Interest" is the expense of borrowing, revealed as a percent of the principal. The "lending term" specifies the duration over which the borrower consents to settle the loan.

One news more essential principle is "month-to-month payment," calculated based upon the principal, rate of interest, and funding term. Customers need to likewise be aware of "APR" (Interest Rate), which encompasses both the rate of interest and any affiliated fees, giving a clearer image of the overall loaning expense.

Lastly, "default" takes place when a debtor falls short to satisfy settlement terms, potentially resulting in fines or collections. Cash Loans. Comprehending these key terms gears up consumers to navigate their installation funding alternatives successfully

Pros and Cons of Installation Loans

Benefits of Installment Loans

Installment financings come with both benefits and disadvantages, their structured settlement design typically charms to debtors seeking financial security. One significant advantage is the predictability of month-to-month repayments, which permits debtors to spending plan effectively. These lendings typically have taken care of interest prices, making it much easier to visualize total prices over the loan's duration. Furthermore, installation fundings can aid build credit report, as prompt repayments mirror favorably on credit scores reports. Borrowers might additionally access bigger quantities of money compared to typical credit options, promoting significant purchases such as homes or lorries. This accessibility makes installment loans an eye-catching choice for individuals seeking prompt funding while keeping workable repayment terms with time.Drawbacks to Consider

While installation financings offer a number of advantages, there are noteworthy disadvantages that possible consumers ought to very carefully take into consideration. One substantial issue is the potential for high interest rates, particularly for those with poor credit score, which can result in significant overall payment quantities. Additionally, the dealt with monthly repayments can stress monthly spending plans, especially throughout monetary difficulties. Borrowers may likewise encounter fines for missed repayments, which can further worsen their financial circumstance. Additionally, the long-term nature of these car loans can lead to prolonged debt, restricting future loaning ability (Cash Advance). Some individuals might find themselves in a cycle of debt if they consistently depend on installment financings to handle their finances, making it necessary to evaluate their economic health and wellness prior to devoting to such responsibilities.Suitable Debtor Situations

Installment fundings can be particularly helpful for specific debtor scenarios, making it essential to understand that might discover them beneficial. They are excellent for individuals seeking to finance significant costs, such as home remodellings, educational searches, or big purchases, as they supply foreseeable regular monthly repayments gradually. Customers with secure revenue and a good credit report can secure beneficial terms, making repayment convenient. However, these loans may not fit those with irregular earnings or inadequate credit, as they could face greater rate of interest prices or undesirable terms. Additionally, debtors ought to beware of overextending themselves, as missed payments can bring about significant monetary pressure. Ultimately, comprehending personal financial circumstances will certainly figure out the viability of an installment lending.Variables to Consider Prior To Applying

Prior to looking for an installment lending, potential customers should thoroughly assess several essential aspects. First, they have to examine their credit history, as it greatly affects car loan qualification and rate of interest prices. A greater rating normally leads to better terms. Next off, debtors should consider their present financial situation, including revenue stability and existing debts, to identify their ability Continue to manage month-to-month settlements.An additional vital element is the car loan quantity and term size. Customers must verify that the funding satisfies their needs without exhausting their finances. Additionally, it is important to review the lending institution's track record and client service, as this can impact the borrowing experience. Recognizing the overall cost Get More Info of the financing, including charges and interest prices, will assist customers make educated decisions and prevent unanticipated economic worries. By taking into consideration these variables, individuals can better navigate the process of obtaining an installation loan.

Often Asked Inquiries

Can I Settle an Installment Car Loan Early Without Penalties?

Yes, numerous installment finances permit very early payment scot-free. Terms can differ by lender, so it's essential for consumers to assess their loan contract to understand any type of potential costs associated with early benefit.Just how Does My Credit History Influence My Installment Finance Terms?

A person's credit report considerably influences installment finance terms. Greater scores frequently cause lower rates of interest and far better settlement conditions, while reduced ratings might lead to higher prices and much less positive terms for debtors.Are Installation Loans Available for Bad Credit Scores Customers?

Yes, installment fundings are offered for bad credit scores borrowers. These people might encounter greater interest rates and less favorable terms due to viewed threat, making cautious consideration of alternatives vital prior to proceeding.What Occurs if I Miss a Payment on My Installment Financing?

Missing out on a payment on an installation finance can bring about late costs, raised rates of interest, unfavorable effects on credit history, and possible collection actions. Debtors are recommended to connect with loan providers to discuss feasible options.Can I Obtain Several Installment Car Loans at the same time?

Yes, individuals can acquire numerous installation lendings simultaneously. Lending institutions generally analyze their creditworthiness, repayment ability, and general monetary circumstance prior to authorizing extra financings, ensuring the borrower can manage multiple obligations without economic stress.Installment car loans are a kind of financing that enables debtors to obtain a lump sum of cash upfront, which they then settle over a set period via arranged settlements. Customized fundings, such as vacation or wedding event financings, serve particular niche needs, allowing consumers to fund unforgettable experiences. Next off, customers fill out a car loan application, offering personal details and the preferred finance quantity. Installment car loans come with both negative aspects and advantages, their structured settlement version commonly appeals to borrowers looking for financial security. These finances generally have actually repaired interest prices, making it simpler to anticipate complete prices over the finance's period.

Report this wiki page